Friday, 20th December 2019

International Group of P&I Clubs - Reinsurance Subcommittee - PRESS RELEASE – 2020/21

“A major strength of the International Group remains its pooling arrangements and the General Excess of Loss and Collective Overspill Programme (GXL programme), which provides shipowners with un-paralleled levels of cover. All shipowners will be aware of the hardening reinsurance market and upward pressure on premiums. Despite this, the longevity and relative stability of the GXL programme has enabled the Group to achieve renewal for 2020/21 on expiring rates for shipowners. Of additional benefit, the US$2 billion excess of US$100 million placed in the commercial market has been confirmed for two years. This will help provide a degree of reinsurance pricing stability for the next two years whilst maintaining flexibility to fund claims within the Pool.

Structurally, the GXL programme is relatively unchanged, with the emphasis having been on continuity and respecting the long term relationships that the Group has built up with many of the world’s leading reinsurers. Those relationships have enabled the Group to achieve a fair balance between the commercial reinsurance market and the risk retained risk by the Group through Hydra, its captive.” (Mike Hall – Chairman, International Group Reinsurance subcommittee)

Renewal Overview

The loss experience of the GXL programme on the policy years 2012/13 to 2019/20 (year to date) remains acceptable to reinsurers. The Group’s reinsurance captive Hydra continues to give positive results through its loss retention strategy. In addition, there has been considerable appetite in the market to write multi-year private placements at competitive pricing. Together, these factors enabled the Group to achieve another satisfactory GXL programme renewal result, with rates for shipowners remaining flat across all vessel categories.

Individual Club retention and GXL programme attachment

Individual Club retention (ICR) remains unchanged for the 2020/21 policy year at US$10 million, as does the structure of the Pool above that and the attachment point for the GXL programme. The further ICR of 7.5% in the upper layer of the Pool remains unchanged.

Reinsurance structure changes

Following the structural changes made in 2019/20 year (which also saw co-brokers being appointed), the Group’s Reinsurance subcommittee decided not to make significant changes this year. This was to allow time for the new programme to bed in and produce results.

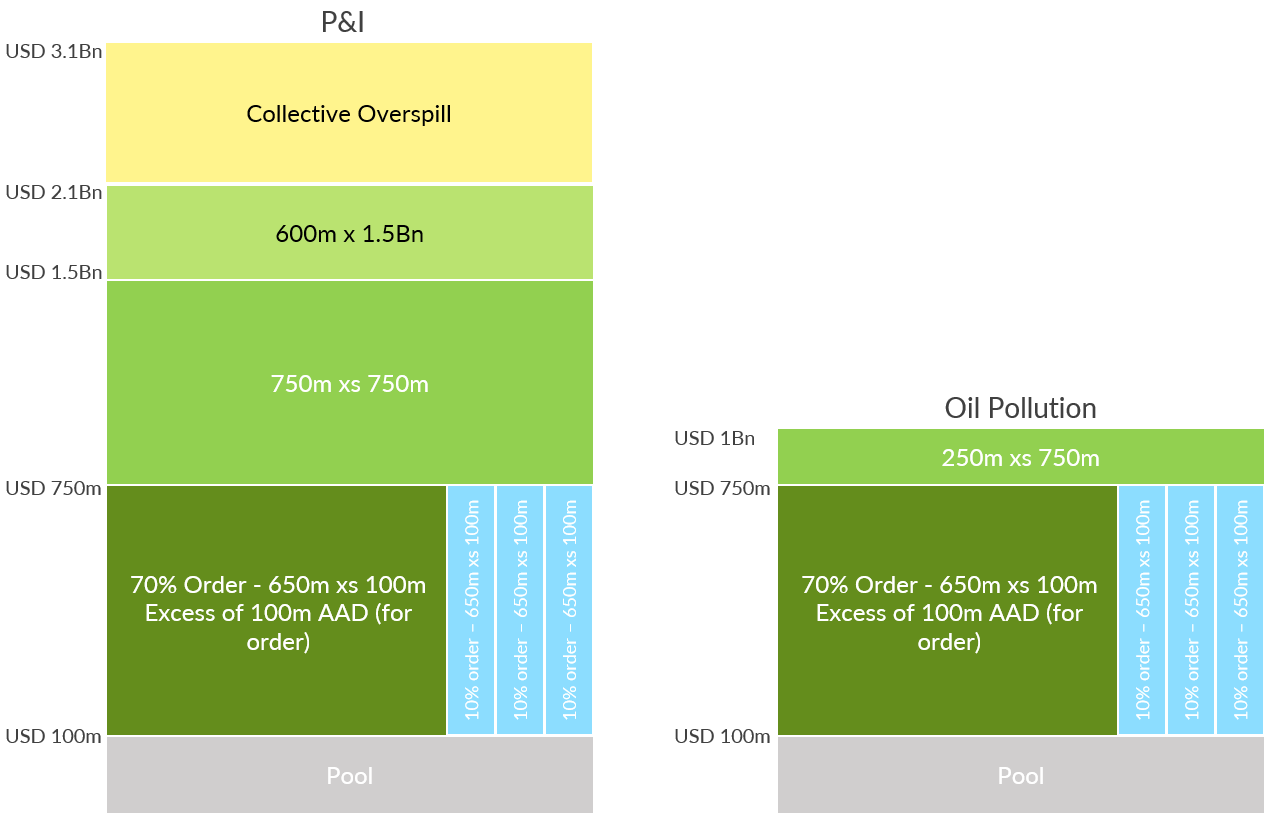

However, for 2020/21 there is a modest adjustment, with the two expiring 5% private placements in the US$1 billion excess of US$100 million layer being replaced by two new 10% multi-year private placements in the first layer. This will therefore see three 10% private placements for the 2020/21 policy year, with the 70% balance placed in the market.

Otherwise the US$100 million AAD (retained by the Group’s captive Hydra), within the 70% market share of the first layer of the programme (from US$100 million to US$750 million (“first layer”)) remains. The second layer will cover US$750 million to US$1.5 billion and the third layer from US$1.5 billion to US$2.1 billion. There is no change to the Collective Overspill layer, which provides US$1 billion of cover in excess of US$2.1 billion.

Hydra participation

Hydra continues to retain 100% of the Pool layer US$30 million – US$50 million and 92.5% of the Pool layer US$50 million – US$100 million. In addition, Hydra will retain a US$100 million AAD in the 70% market share of the GXL programme.

MLC cover

The US$200 million (excess of US$10 million) market reinsurance cover will be renewed unchanged for a further 12 months from 20 February 2020. That renewal has also been achieved at a competitive cost, which has been included within the overall reinsurance cost.

War cover

The excess War P&I cover will be renewed for 2020 for a period of 12 months, with the costs included in the total rates charged to shipowners. There is a change to the terms of the placement in order to maintain the excess nature of the cover provided, increasing the minimum attachment point of the cover (where the vessel is not protected by Primary War P&I up to proper hull value) from US$100 million to US$500 million.

2020/21 GXL programme structure

The diagram below illustrates the revised layer and participation structure of the GXL programme for 2020/21.

Reinsurance cost allocation 2020/21

The Group’s Reinsurance Subcommittee continue to review the historical data on loss versus premium of the current four vessel-type categories.

Based on the latest review, the Reinsurance Subcommittee considered that there should be no change in the cost of any of the four vessel-type categories.

Whilst the commercial market element of the placement has been confirmed for two years, Hydra’s participation on the placement continues to be meaningful. Therefore, the Reinsurance Sub-committee has decided to set rates for the 2020/21 policy year only. The cost of Hydra’s participation for the 2021/22 year will be assessed in 12 months’ time and any rate adjustment for the 2021/22 rates will be applied at that time.

The 2020/21 rates are set out below:

| Tonnage category | 2020 rate per gt – in US cents |

|---|---|

| Persistent Oil tankers | 57.47 |

| Clean Tankers | 25.82 |

| Dry | 39.71 |

| Passenger | 321.61 |

| Chartered tankers | 21.58 |

| Chartered dries | 10.54 |

This is another positive reinsurance renewal for the International Group and its Members.

Mike Hall – Chairman of the International Group Reinsurance Subcommittee.