Tuesday, 19th December 2023

The International Group (IG) Pooling and Group Excess of Loss Reinsurance contract (GXL) structure for the 2024/25 Policy Year has now been finalised.

This press release details the background to the IG’s GXL renewal rates for the 2024/25 policy year.

Following a relatively benign Pool claims environment for the 2022/23 Policy Year, 2023/24 has also started well. Whilst there has been some deterioration for prior years’ claims within the Pool, the overall impact on the Group’s reinsurance partners has not been significant and the hurricane season was less impactful than in the previous year with other non-marine losses.

The GXL allows IG Clubs to offer uniquely high levels of free and unlimited coverage for most of the risks they insure. In securing this renewal, the IG remains grateful for the ongoing support of its leader, AXA XL, and also to its many other longstanding reinsurance partners.

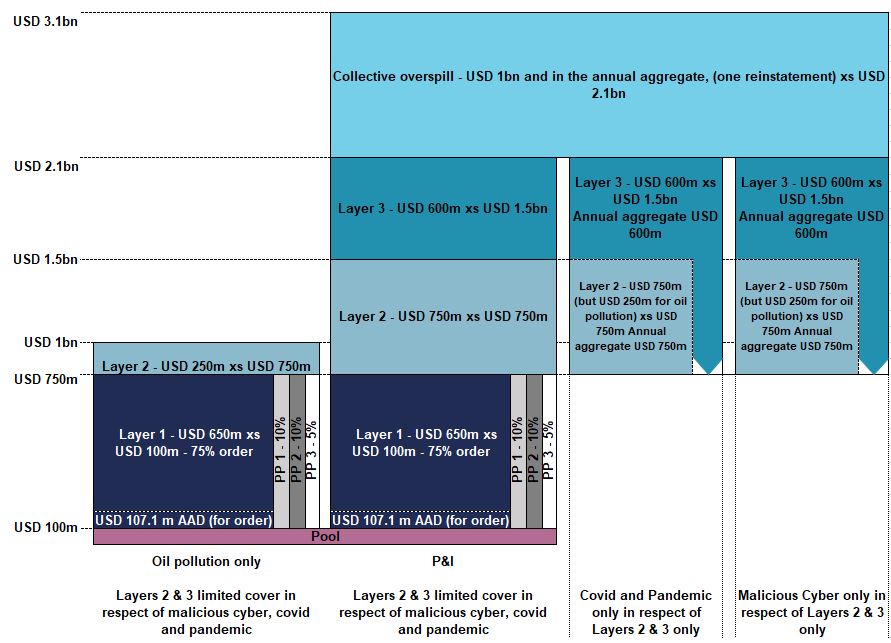

As part of the GXL, the IG maintains three private placements amounting to 25% of Layer 1 of the programme (USD 650m xs USD 100m).

For Layers 2 and 3 the COVID-19/Pandemic risk aggregated cover has been split from the Malicious Cyber aggregated cover. For both these risks there continues to be free and unlimited cover for all claims up to USD 650m xs USD 100m, but now with two towers of separate aggregated cover for claims above USD 750m up to US$2.1 billion.

To ensure the fairness of cost allocation between different vessel types, each year the IG’s Reinsurance Committee considers the vessel categories used. Having given due consideration to possible variations, for 2024/25 those categories remain unchanged with the rates having been adjusted as set out in detail at the end of this release.

Statement from Mike Hall, Chairman of the IG’s Reinsurance Committee

“I am delighted to announce a positive renewal for shipowners for February 2024, with all vessel types seeing rate reductions. The IG has managed its claims profile extremely efficiently over the last few years and the efforts of Clubs and shipowners in their loss prevention programmes have helped to contribute to a more benign claims environment, despite two major conflicts and other geopolitical challenges.

The excellent communications between the IG and the GXL leader, AXA XL, as well as with the IG’s many longstanding reinsurance partners, has reinforced both the importance and unique nature of the IG’s coverage requirements in support of the global shipping community, which helps to facilitate global maritime trade. I am therefore grateful to them and to the IG’s brokers for their continued support in finalising this year’s reinsurance programme.”

Renewal Overview

The main GXL placement (Layers 1-3, USD 2 billion excess of USD 100m) has been maintained as three layers. There continues to be the USD 1 billion Collective Overspill cover excess of the GXL together with three private placements in Layer 1 (maintaining their 25% overall share).

An overview of the entire GXL for 2024/25 is as follows:

- Individual Club’s retention on any claim remains at USD 10 m;

- Claims are pooled between Group Clubs for USD 90 m excess USD 10 m;

- Excess USD 100 m, the GXL applies as follows:

- Layer 1 USD 650 m excess USD 100m; Layer 2 USD 750 m excess USD 750 m; Layer 3 USD 600 m excess USD 1.5 bn;

- 75% of Layer 1 and 100% of Layers 2 and 3 are placed with the open market on a free and unlimited basis, except for risks in respect of malicious cyber, COVID-19 and Pandemic. For those risks, for the 2024/25 policy year, there remains free and unlimited cover for claims up to USD 650m excess of USD 100m. This covers almost all Clubs’ certificated risks. Excess of USD 750m there is up to US$1.35bn of annual aggregated cover in respect of Malicious Cyber cover and separate annual aggregated cover of USD1.35bn in respect of COVID-19/Pandemic risks. Excess of that aggregated cover, the IG continues to pool any reinsurance shortfall, resulting in no change to shipowners’ cover.

- 25% of Layer 1 is covered by three private market placements, which are renewed independently of the open market element of the GXL;

- Hydra continues to retain an Annual Aggregate Deductible (“AAD”) in Layer 1, which remains at the same value as for the 2023/24 policy year in 100% terms. With the open market layer at 75%, the value of this AAD remains at USD 107.1m for the 2024/25 policy year.

- Other placements: The Collective Overspill (USD 1bn excess of USD 2.1 bn) and ancillary covers are being renewed with premiums included within the overall rate per GT.

The IG’s Bermudan based reinsurance captive Hydra continues to support the IG through its risk retention. This enhances stability in pricing. The use of private placements has also continued to give shipowners greater stability.

The GXL continues to allow the broadest cover for shipowners, with reductions for all vessel categories as outlined later in this paper.

Individual Club retention and GXL programme attachment

Following a comprehensive review of the retention structure it has been decided to maintain the Individual Club Retention unchanged for the 2024/25 policy year at USD 10 million. The structure of the Pool and the attachment point for the GXL also remains unchanged.

MLC cover

The MLC market reinsurance cover is being renewed for 2024/25 at competitive market terms, with the premium included in the overall reinsurance rates charged to shipowners.

War cover

The excess War P&I cover will be renewed for 2024/25 for a period of 12 months. Again, this will be included in the total rates charged to shipowners.

However, due to the ongoing active war between Russia and Ukraine, the IG’s Excess War reinsurers have maintained their requirement for Territorial Exclusion language (consistent with exclusionary language already applied by reinsurers for Primary War P&I coverage) for vessels trading in these waters. As such the Group has purchased aggregated sub-limited cover of USD 80m from the reinsurance markets to cover the Russia/Ukraine/Belarus excluded risks.

2024 GXL programme structure

The diagram below illustrates the layer and participation structure of the GXL programme for 2024/5.

Reinsurance cost allocation 2024/25

As mentioned above, as part of its annual analysis and in addition to reviewing premiums, the IG’s Reinsurance Committee has looked at vessel categories.

The conclusions are that there should be no change in the number of categories at this time, but that there should be some adjustments to the relative rate changes having regard to each category’s historical claims performance against the GXL.

The 2024/25 rates are set out below:

|

Tonnage category |

2024 rate in US cents per GT |

% change in rate per GT |

|

Persistent Oil Tankers |

61.63 |

-7.5% |

|

Clean Tankers |

39.82 |

-1.7% |

|

Dry |

58.63 |

-2.1% |

|

FCC |

72.04 |

-1.0% |

|

Passenger |

338.42 |

-12.5% |

|

Chartered tankers |

31.27 |

+0.0% |

|

Chartered dries |

15.26 |

+0.0% |